Chart from Canalys

Chart from Canalys

Southeast Asia smartphone market gets off to a strong start in 2024

Korean phone maker Samsung reclaimed the top spot.

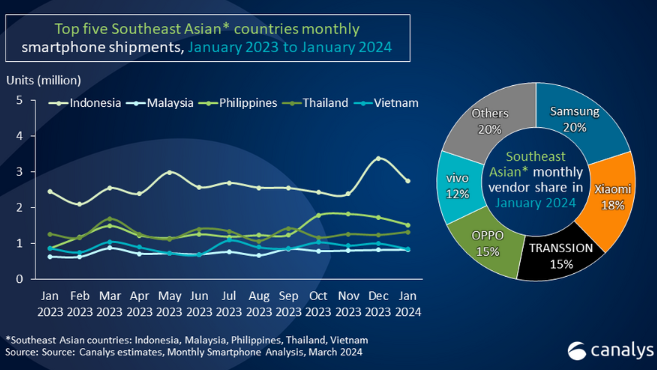

Smartphone shipments in Southeast Asia’s five largest markets surged 20% year-on-year to 7.26 million units in January as demand for new products picked up, data from industry research provider Canalys showed.

Canalys said manufacturers focused on decreasing sell-in and clearing outdated inventory last year to help normalise inventory levels, opening up opportunities for vendors to actively put out new products in the market.

Samsung was the top-selling brand that month in the region thanks to the successful launch of its premium S24 series and the debut of Galaxy AI. Chinese phone manufacturer Transsion lost the first place to the Korean giant.

“Inflationary pressures are now stabilizing, buoyed by government support, leading to a resurgence in consumer sentiment and expenditure,” said Canalys analyst Le Xuan Chiew. “To capitalize on this market resurgence, smartphone manufacturers, which adopted conservative strategies in the last six months, are now deploying aggressive tactics to gain market dominance.”

By geography, Indonesia was the largest smartphone market in January with 2.7 million units shipped, up 12% year-on-year and accounted for 38% of all the shipments in the region.

The Philippines retained its second spot despite seeing a 77% surge in shipment volume to 1.5 million units that month, resulting in a 21% market share.

Thailand saw shipments rise 5% to 1.3 million units while shipments in Vietnam slipped 2% to 848,000 units in January. Meanwhile, smartphone shipments in Malaysia jumped 33% to 831,000 units that month.

“Balancing device affordability with prudent inventory management poses the primary challenge for smartphone vendors, particularly as channel partners exercise caution following a challenging start to the year” Chiew said. “Looking ahead, it is imperative for smartphone vendors to seek out new avenues for growth.”