Chart from SIA, BCG

Chart from SIA, BCG

Taiwan, Korea to see market lead in advanced chips drop in 2032 as US plays catch up

Expansion of China's chip capacity will dramatically slow down this decade.

After dominating the global production of advanced logic chips, Taiwan and South Korea will see their market share drop to 56% by 2032 as the United States catches up fast with the boost from its landmark CHIPS Act.

A new report by the Semiconductor Industry Association (SIA) and the Boston Consulting Group (BCG) showed Taiwan’s production of logic chips newer than 10 nanometers will decline to 47% of the global capacity by 2032 from having produced 69% in 2022.

Korea’s share is also forecasted to plunge from 32% in 2022 to just 9% in the next decade, while the US is set to become a market leader by producing an estimated 28% of the world’s supply of these advanced semiconductors by 2032, from having zero market share in 2022.

The market shift will be driven by increased investments in this space with the US estimated to capture over one-quarter of the global capital expenditures from 2024 to 2032 in large part thanks to its CHIPS Act. The economic powerhouse ranks second to Taiwan which will account for 31% of the total spending during the same period, according to SIA and BCG.

Europe (6%) and Japan (5)% are also expected to develop a meaningful share of the world’s advanced logic chips by 2032, while China and other geographies account for the remainder 5%.

“A number of factors— from geopolitical tensions and a more complex regulatory environment to labor shortages and rising costs—have underscored the need for supply chain diversification and investments to improve resiliency.

“Our report then highlights the path toward greater resilience, including sustaining government support, guarding against supply-demand imbalances, integrating new countries, maintaining vibrant global trade, and fostering global talent,” SIA and BCG said. “As geopolitical frictions persist, it is important to maintain a global supply chain and support a more diverse global production footprint.”

Production of logic processes in the range of 10nm to 22nm and even those older than 28nm will remain well distributed across geographies according to the report, although mainland China is expected to post the biggest gain.

China’s global share of 10-22nm chips is set to grow from 6% in 2022 to 19% in 2032, while its production capacity in 28nm chips or older is seen rising from 33% to 37%.

Korea keeps lead in memory

In the memory space, SIA and BCG said Korea is poised to maintain its lead to account for 57% of the world’s technologies, dynamic random access memory (DRAM) capacity in 2032, followed by Taiwan (17%) and China (13%).

NAND memory production, meanwhile, will be more concentrated in Korea and Japan with the two nations expected to make up 75% of the world’s capacity in the coming decade.

Overall, the report showed the anticipated market shift will see China’s share of the global wafer fab capacity dip to 21% by 2032 from having produced 24% of the world supply in 2022.

China growth slows

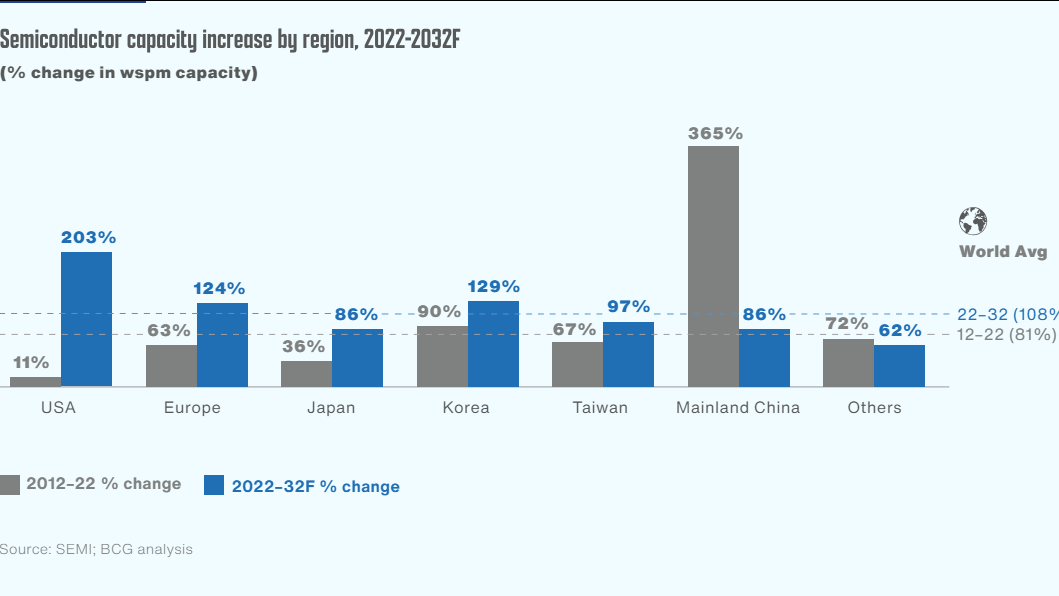

China is seen slowing down with its semiconductor capacity projected to expand by 86% in the 10 years to 2032, after having grown production by more than fourfold in the previous decade.

Taiwan will also see its global market share slip to 17% from 18% currently, despite efforts to continue ramping up capacity.

Korea, meanwhile, is expected to grow its presence to 19% of the global wafer fab capacity in 2032 as the nation is set to more than double its chip capacity in the coming decade.

The US will post the fastest growth with an estimated 203% jump in capacity between 2022 and 2032, up from just an 11% rise in the previous decade.