Photo Mikhail Nilov via Pexels

Photo Mikhail Nilov via Pexels

APAC semiconductor firms invest heavily in talent

The scarcity of skilled talent looms as the industry’s foremost challenge in the next 3 years.

SEMICONDUCTOR companies across the Asia Pacific (APAC) region are doubling down on investments in talent development amidst a period of rapid technological advancement and a pressing shortage of skilled professionals.

To maintain a competitive edge and weather through these challenges, firms are strategically focusing on employee career growth, skills enhancement, and the implementation of diverse strategic initiatives.

Talent development strategies

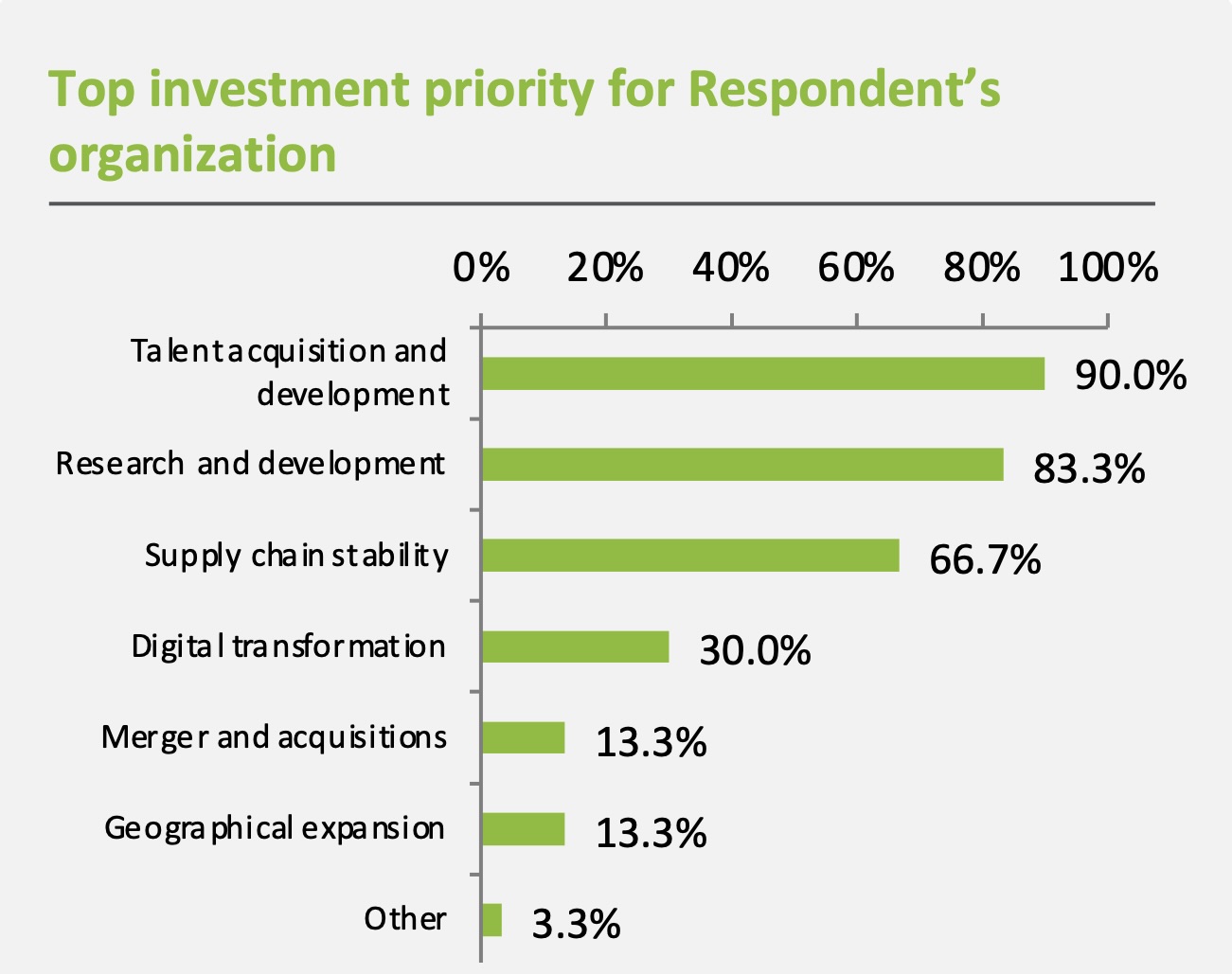

In Deloitte’s APAC Semiconductor Industry Trends report, over 90% of companies identified talent development as their primary investment focus to sustain industry growth and competitiveness.

The scarcity of qualified professionals, cited by 70% of respondents, is leading to project delays and increased outsourcing costs.

Nearly 100% also emphasised the importance of providing clear career roadmaps, with 80% prioritising investment in skills development.

This aligns with the global sentiment highlighted in the 2024 KPMG Global Semiconductor Industry Outlook report, which sees the shortage of skilled talent as the biggest industry challenge over the next three years.

To counteract this trend, semiconductor firms are implementing various strategies such as forging partnerships with universities to cultivate more STEM talent, reinforcing employee value propositions, offering remote work options, and providing enticing incentives like annual bonuses.

In Malaysia, for instance, the electronics and electrical sector boasts a workforce exceeding 600,000, supported by a robust educational system comprising 20 public and 53 private tertiary institutions, along with over 1,400 technical and vocational education and training colleges, according to EY’s report titled, “When the chips are down: ASEAN could be the answer to the semiconductor crunch.”

Nelson Samuel Consul, director at the Malaysian Investment Development Authority New York, said Malaysia’s position as a hub for advanced manufacturing and R&D is strengthened by its cost competitiveness and skilled talent pool.

In the Philippines, a highly skilled and English-proficient labour force, with an average age of 24, also forms the backbone of the workforce.

Benedict Uy, Philippine Department of Trade and Industry Trade commissioner and director of the Philippine Trade and Investment Centre, New York, said initiatives such as innovation centres and technology-based policies are attracting top semiconductor companies.

Singapore, for its part, offers businesses access to skilled labour through various talent development schemes, including training grants and professional conversion programs, as noted by Jingxin Zheng, regional vice president for the Americas at the Singapore Economic Development Board.

APAC dominance

The APAC region accounted for a 57.6% share of the global semiconductor industry in 2022.

Amongst the top 15 global semiconductor companies, four hailed from APAC. China emerged as the world’s largest semiconductor equipment market, with the Chinese mainland and Taiwan accounting for 26% and 25% of global semiconductor equipment sales, respectively.

Geopolitical tensions such as the US-China trade war, Russia-Ukraine war, and the South China Sea disputes, slow post-pandemic recovery, inflationary pressures, and demand fluctuations have collectively contributed to a slowdown in the region’s semiconductor market growth since 2021.

Still, nearly 50% of APAC semiconductor players remain optimistic, foreseeing accelerated market growth in the next three to five years. Many anticipate annual revenue growth exceeding 10%, with a focus on new product and solution development.

Future outlook

The global semiconductor market is anticipated to witness a surge of 13.1% in 2024, primarily fueled by a resurgence in downstream demand and sustained growth in the market for generative AI products and power discrete devices, according to Deloitte's report.

The KPMG report further reinforces this optimism, with 85% anticipating revenue growth and 69% projecting increased R&D spending, and 55% expecting global workforce expansion.

Automotive remains the primary revenue driver, followed by AI, whilst microprocessors are identified as the leading product opportunity for industry growth.