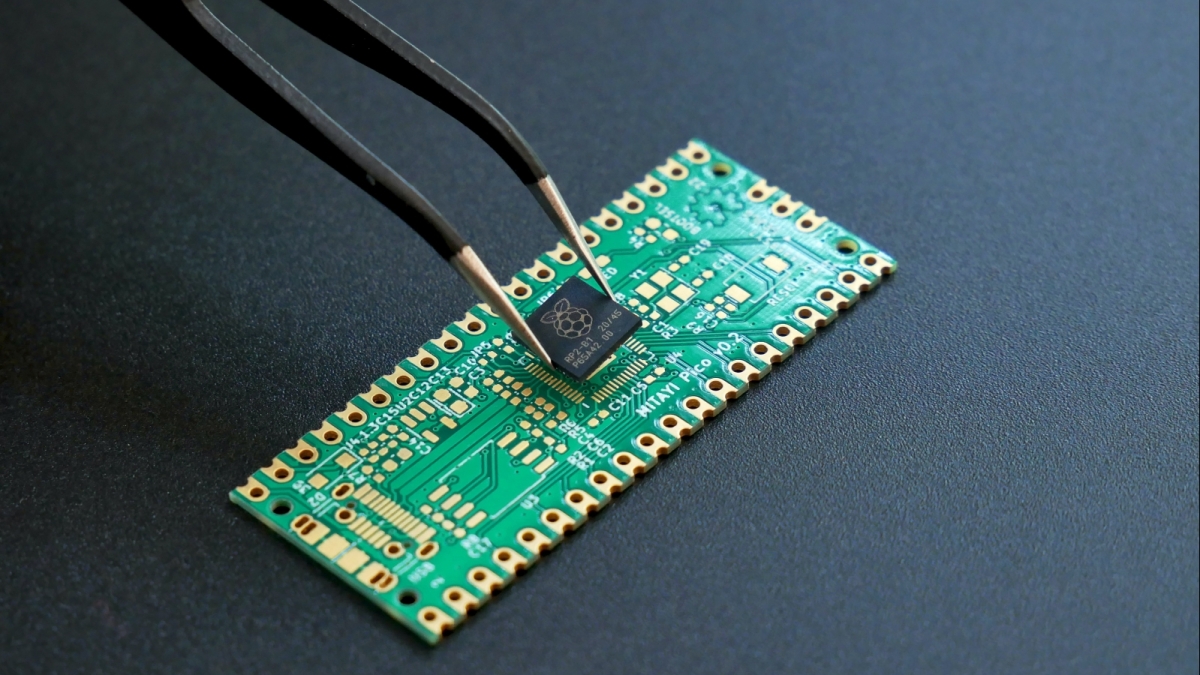

Photo by Vishnu Mohanan on Unsplash

Photo by Vishnu Mohanan on Unsplash

APAC chip sector set for double-digit rebound in 2024, become a $317B market

The sector is still doomed to shrink 14.4% this year.

Asia Pacific’s semiconductor sector is projected to grow by 12% to become a $317.5B industry next year, bouncing back from its expected double-digit drop this year, according to the World Semiconductor Trade Statistics (WSTS).

The latest WSTS Semiconductor Market Forecast Fall showed the region’s chip sector is estimated to slump by 14.4% to $283.3B for full-year 2023, extending the 3.5% dip seen in 2022.

Despite next year’s anticipated rebound, the sector will still be 4% below its $331B valuation in 2022. Nonetheless, Asia will remain the largest semiconductor market in the world to account for 54% of the projected $588B global semiconductor market in 2024.

READ MORE: Fitch Ratings says APAC chip makers to ride out market downturn

The Americas ranks second with a projected 22% jump next year to reach a $162B market valuation from $133B this year.

Europe’s chip sector, meanwhile, is expected to remain stable with a 4.3% uptick in 2024 to $59.5B, compared with the estimated 5.9% growth in 2023.

The Japanese semiconductor market is also seen inching up by 4.4% next year to become a $49.3B market next year, reversing the 2% dip this year.

Globally, WSTS projected the world’s semiconductor market to recover by 13% and climb to the $588B mark next year after a sharp contraction this year. It estimated the global market to shrink by 9.4% to end at $520B in 2023 from its $574B valuation last year.

The memory sector is also set to do the heavy lifting of the global chip rebound next year, with the segment alone poised to rise by 45% to $130M in 2024.